Hello Guys, As per section 139AA of the Income Tax Act 1961, it is compulsory to link Aadhaar number with PAN by 30th June 2021. The Income tax department will levy a fee of Rs.1000 if you fail to link your PAN card and Aadhaar on or before 30th June 2021. If you have already linked/seeded your PAN with your Aadhaar, you can check the status also here. Lets Get Started.

Step to Follow:

- Click Here to Open Income Tax Website – Click Here

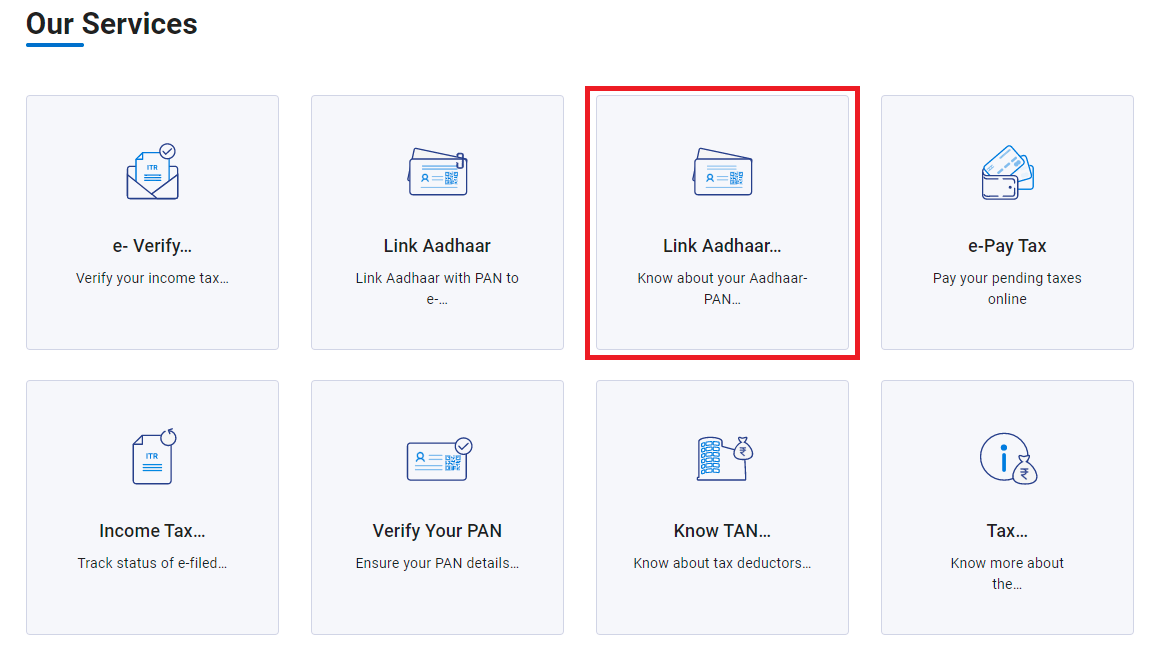

- Scroll Down and then Click 2nd Link Aadhaar to Check the Status of Pan Aadhaar.

- Now Enter Your Pan and Aadhaar number to check it is already linked or not.

- After Check, If you want to link then come to main page.

- Now Click 1st Link Aadhaar Option.

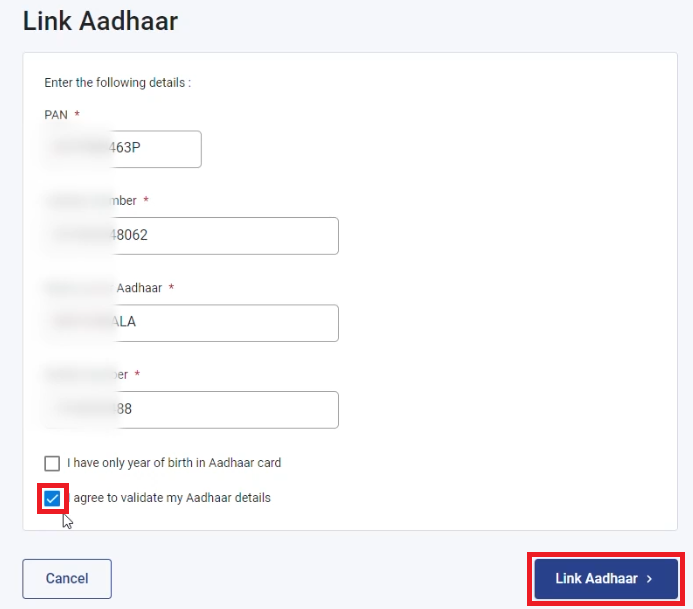

- Enter Your Pan Number, Aadhaar Number, Name as per Aadhaar and any Mobile Number.

-

Now Tick “I have only year of birth in Aadhaar card” If You have Birth Year only in your Aadhaar card.

-

If not then wont Tick “I have only year of birth in Aadhaar card”

-

Finally Tick “I agree to validate my Aadhaar details” then Click Link Aadhaar.

-

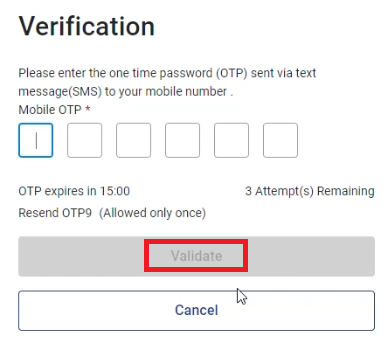

Now Enter 6 Digit OTP then Click Validate.

-

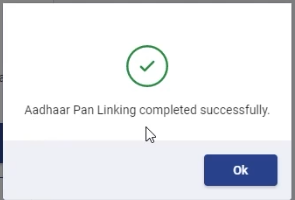

Now You will get a Confirmation message Like below.

- That’s All.

SB CREATION KANNADA

Siddharth

SB CREATION KANNADA

Editing SB CREATION KANNADA

SB CREATION KANNADA

Editing video SB creation Kannada YouTube editing

Nagaraj reddy

Havant comes in this webset